The CFO answers questions about our business in a Q&A format.

KOMORI's Business Development – Offset Press Business

- What is the main business of the KOMORI Group?

The KOMORI Group is a manufacturer and seller of industrial printing machines, with its core product being the offset printing press. These machines are widely used for commercial printing such as packaging, posters, flyers, and books.

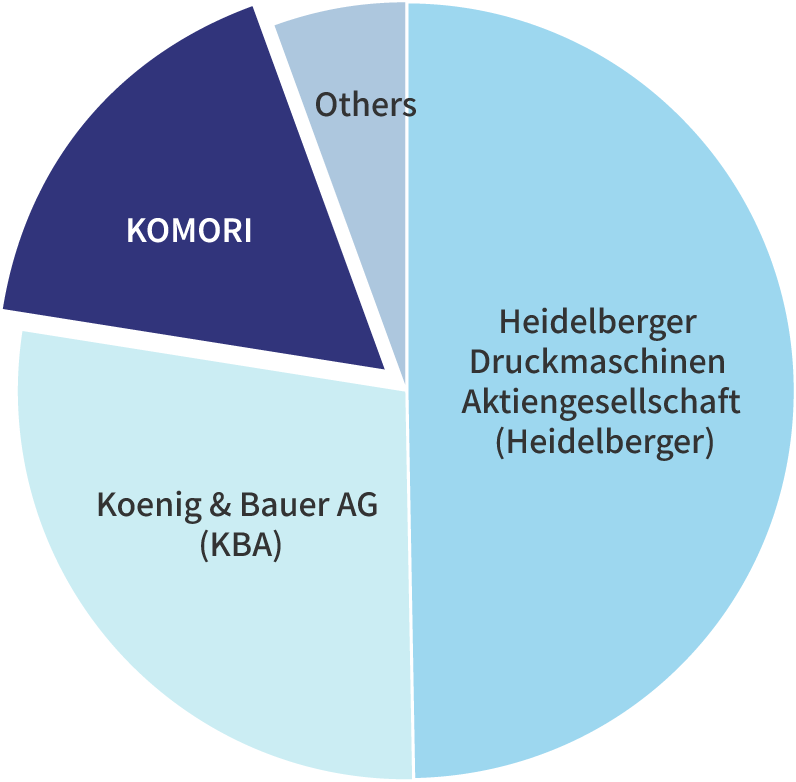

The offset printing press market is estimated to be worth around 400 billion yen in the mid-2020s. Our group holds the third-largest global market share, following two overseas companies, with approximately 15–20% of the global share.

Market share of Offset printing presses

Our estimates based on industry reports and financial disclosures from various companies.

When people hear "printing press," they may think of copiers found in homes or offices. However, in the world of industrial printing, it is essential to print large volumes of high-precision materials like posters and packaging in a short time.

Our printing presses boast productivity levels that allow for printing over ten thousand sheets per hour—far beyond the capabilities of household copiers.

Moreover, Industrial printing machines are extremely large, with a total length of approximately 20 meters—about the same size as a commuter train car.

Installing one requires a space equivalent to a convenience store, roughly 150 to 200 square meters.

The following video, filmed at an exhibition held in China in May 2025, shows the setup of our printing press. The repeated rising and setting of the sun in the video conveys the time and scale involved in assembling the machine.

- To achieve such high-precision printing like photographs with large printing presses, advanced technology must be required, right?

Indeed, printing requires applying multiple colored inks in the correct order and precisely in the same position. This demands extremely accurate paper feeding, achieved through numerous cylinders. These cylinders must be perfectly round, and our cylinders meet precision standards required for rockets and aircraft. All of them are manufactured in-house.

By rotating these cylinders at high speed, we can produce high-quality prints at a rate of over ten thousand sheets per hour.

- How is KOMORI Group’s technological capability evaluated externally?

We have been selected as one of the "Global Niche Top Companies 100" by Japan’s Ministry of Economy, Trade and Industry.

In 2020, 113 companies were chosen, and only 13—including ours—were selected consecutively from the previous 2013 edition.

Our selection was based on multifaceted evaluations including our printing technology, global expansion, and quality control.

Japan’s Only Security Printing Press Manufacturer

- I heard KOMORI’s printing presses were used for the new banknotes issued in 2024. Can you tell us about your security press business?

Yes, we were responsible for manufacturing the banknote printing machines for the new currency issued in 2024.

Since delivering our first banknote printing machine to the Printing Bureau of the former Ministry of Finance in 1958, we have nearly 70 years of experience. Currently, all Japanese banknotes are printed using our machines.

Japan’s banknotes are among the least counterfeited in the world, and we take pride in the fact that our printing and anti-counterfeiting technologies contribute to the safety and security of currency users.

- What kind of anti-counterfeiting printing technologies are used?

The following video introduces our commemorative "House Note," created for our 100th anniversary. (Note: The house note is a sample of special printing created using the same paper, ink, and printing technology as actual banknotes. It is produced by printing machine suppliers and others for the purpose of sales promotion and technical demonstration.)

The video explains the anti-counterfeiting technologies used in the House Note in an easy-to-understand manner.

These include microtext that is nearly invisible to the naked eye, UV security features that reveal hidden images under UV light, latent images that display "100" when tilted, and modulated digital serial signals that vary for each note.

The House Note incorporates nearly 20 anti-counterfeiting technologies, some of which are used in banknotes around the world.

Such detailed technologies help suppress counterfeiting and misuse.

- Are banknote printing machines also delivered to countries outside Japan?

Yes, we supply banknote printing machines internationally.

Only two companies in the world can manufacture these machines, and we are one of them.

Starting with the delivery of a complete banknote production plant to the Reserve Bank of India in 1996, we have actively expanded since the 2010s.

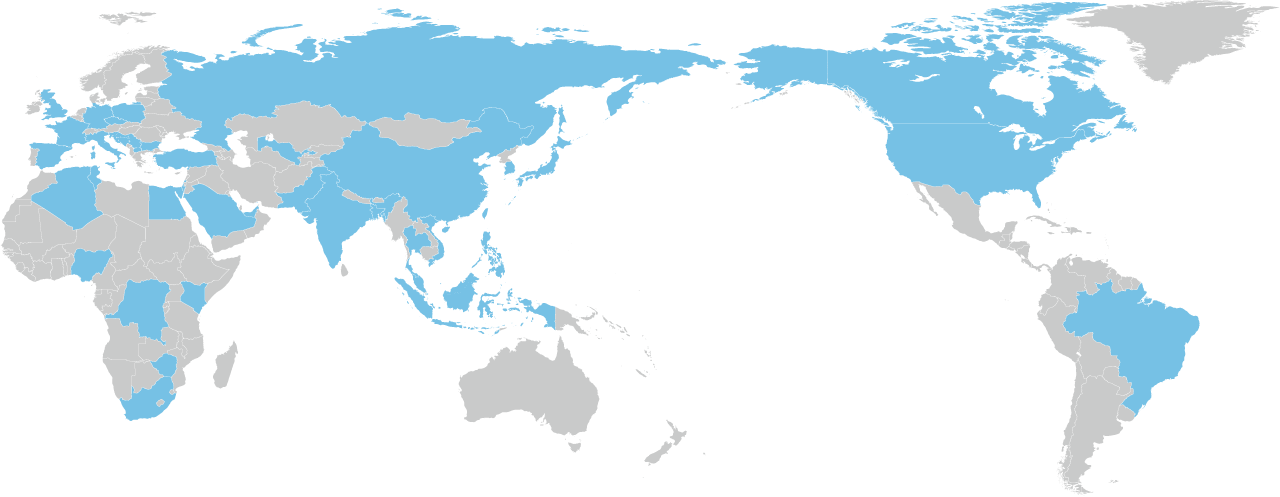

The number of countries adopting our printing machines has expanded rapidly over past decades, and they are now used in 39 countries worldwide. We currently share the global market equally with the other company . In recent years, our market share has even surpassed that of our competitor.

- With the rise of cashless payments, how is the security press business affected?

While cashless and digital currencies are gaining traction, it is unlikely that physical banknotes will disappear entirely.

This is because communication infrastructure carries inherent risks, especially during disasters, where the reliability and immediacy of cash remain crucial.

In emerging countries, due to economic scale and development stages, banknote production is often outsourced to private companies abroad. However, there is a strong desire for domestic production, and self-production is increasing, leading to a rise in banknote circulation.

Additionally, regardless of circulation volume, anti-counterfeiting technologies must be updated periodically, ensuring continued demand.

As long as the global population continues to grow, we expect steady demand for banknotes and, consequently, for banknote printing machines.

Responding to the Digital Shift in Paper Media

- With the shift to digital content in books and advertisements, how is KOMORI responding?

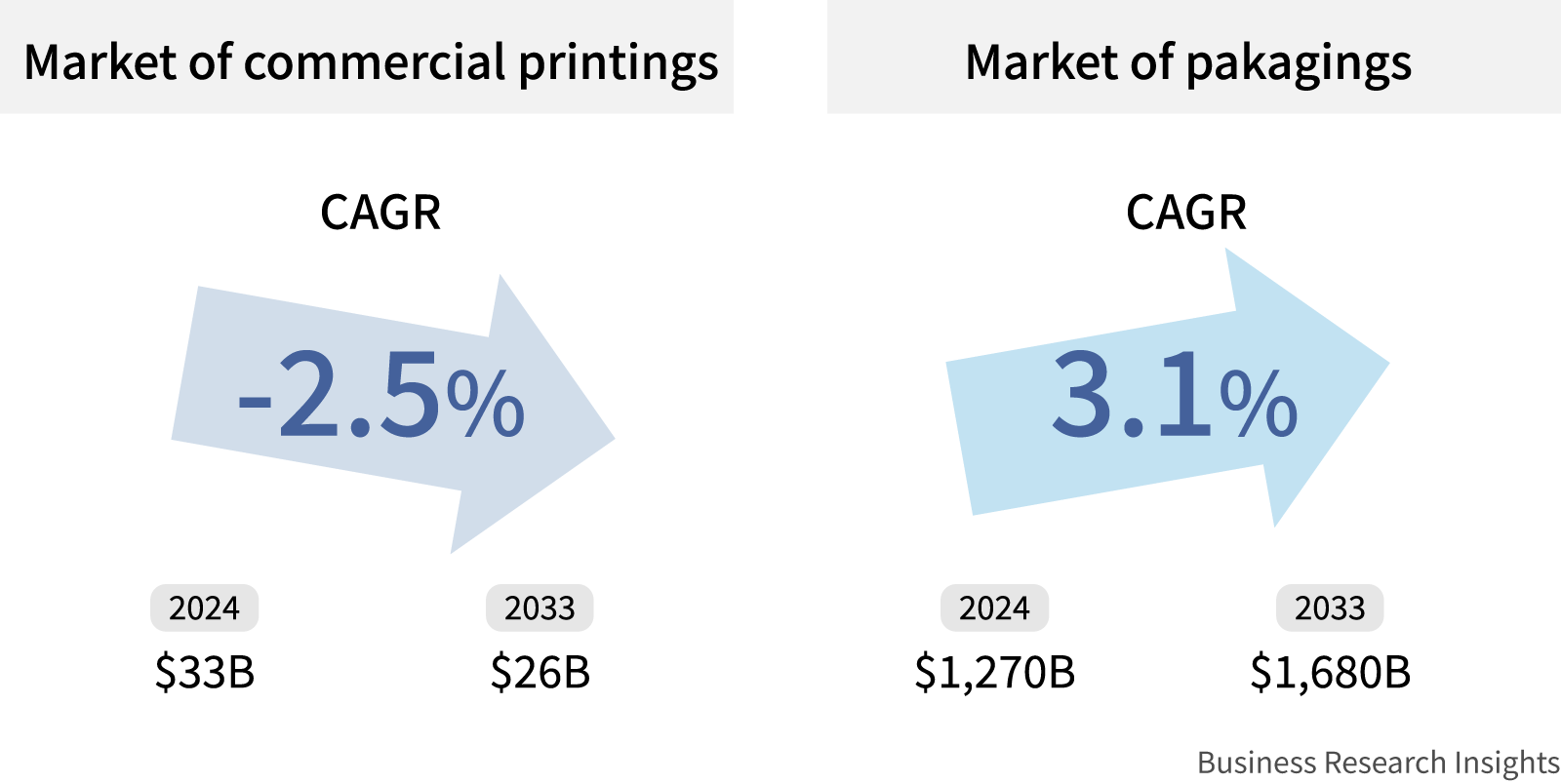

The digital shift in commercial printing like books, flyers, and posters is undeniable.

Newspaper and magazine circulation has significantly declined.

We are focusing on packaging, which remains a vital paper-based medium even amid digitalization.

The following chart shows market forecasts for paper and packaging media across regions.

In particular, packaging for e-commerce, which is growing explosively worldwide, is expected to see strong growth.

- E-commerce is booming globally, so packaging demand must be rising rapidly.

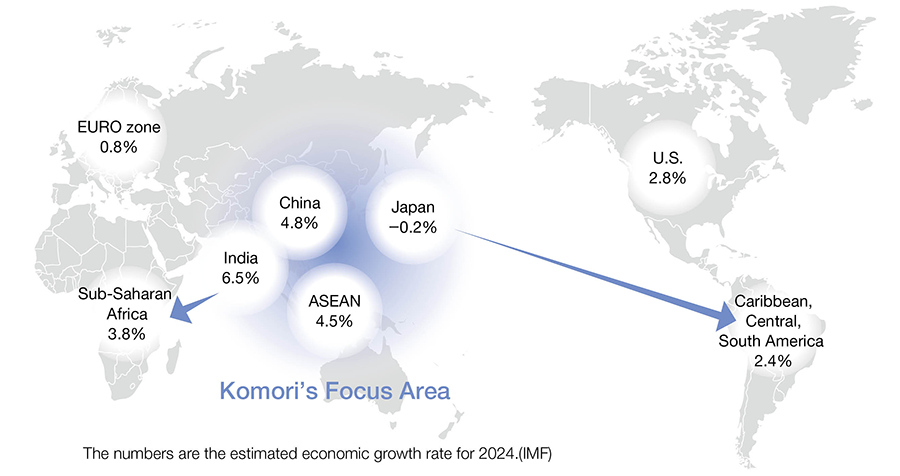

Exactly. Moreover, unlike our two overseas competitors in offset printing, we specialize in high-growth Asian markets.

We strengthened our distribution channels by converting sales agents in Singapore (2014), India (2018), and China (2019) into subsidiaries.

These product and regional strategies contributed to our business recovery through the mid-2020s.

Digital Printing Presses and Smart Factories

- Are there other impacts of the digital shift?

Yes, beyond the shift in paper media, the digital transformation is also affecting printing machines and factory operations.

Digital Shifts In The Printing Industry

| 3 digital shifts | Matters | Countermeasures |

|---|---|---|

| Digitalization of paper media itself | Decline in the number of published books and related materials | Strengthening the packaging sector |

| Digitalization of printing machines | Shortage of operators | Digital presses |

| Digitalization of printing factories | Digital transformation (DX) of the production site | Smart factory transformation |

In the printing industry, digital shift includes:

1:Digitalization of paper media itself

2:Digitalization of printing machines

3:Digitalization of printing factories

The digital shift in the printing industry is not merely about transitioning from paper to digital content—it is also expanding into the operation of machinery and factory management itself.

- What does digitalization of printing machines mean?

Offset presses offer high productivity, printing over ten thousand sheets per hour.

However, they require skilled operators, and the aging workforce is causing labor shortages.

As a solution, digital printing presses are gaining attention.

These machines operate like office printers—just press a button—and are ideal for addressing the shortage of skilled technicians.

In advanced countries with aging populations, the shift to digital presses is accelerating.

Although digital presses print fewer sheets per hour (around 6,500), they excel in flexibility and quick job switching, which suits the trend toward small-lot, multi-variety printing.

While our core customers remain major companies that demand high-productivity offset presses, the 'digital shift in printing machinery' is progressing at a pace that cannot be ignored. In response to this change, we are strengthening our technological development and product offerings in the field of digital printing.

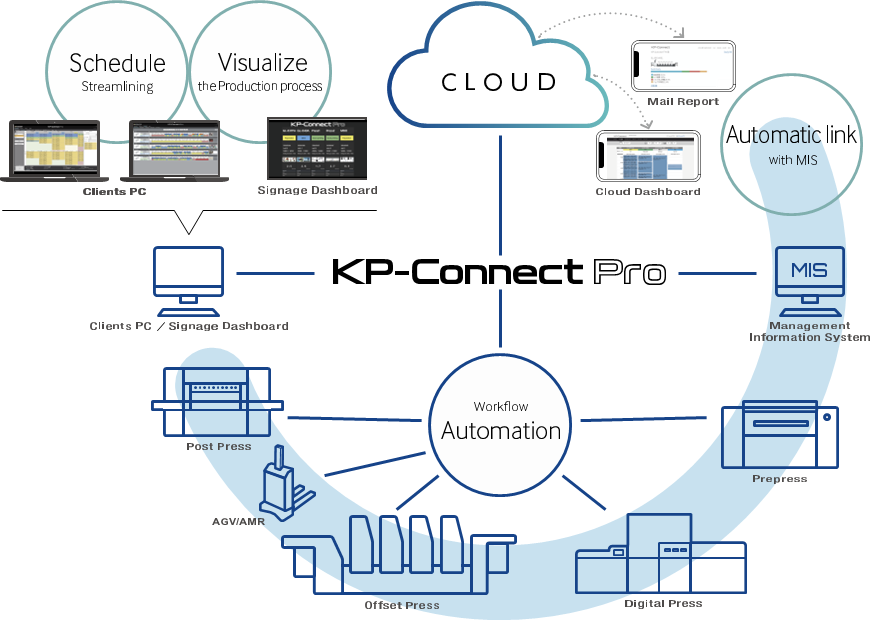

- What does digitalization of printing factories involve?

Similar to trends in manufacturing, printing factories are undergoing DX (digital transformation) in control and management systems.

In offset printing, pre-press processes (e.g., plate adjustments) and post-press processes (e.g., cutting and binding) are critical.

We have formed alliances with over 10 partner companies involved in these processes to promote data integration, visualization, automation, and streamlining.

This collaboration enables real-time monitoring of factory operations and accelerates DX and smart factory development.

Our German subsidiary MBO has also developed automation tools like the robot "MBO Cobo-Stack", which accurately stacks printed sheets, contributing to labor-saving and efficiency.

Expanding into the Semiconductor Industry with Printed Electronics (PE)

- So far, we’ve discussed securities printing, packaging, and digital presses. Are there other focus areas?

Yes, we are expanding our customer base beyond the printing industry.

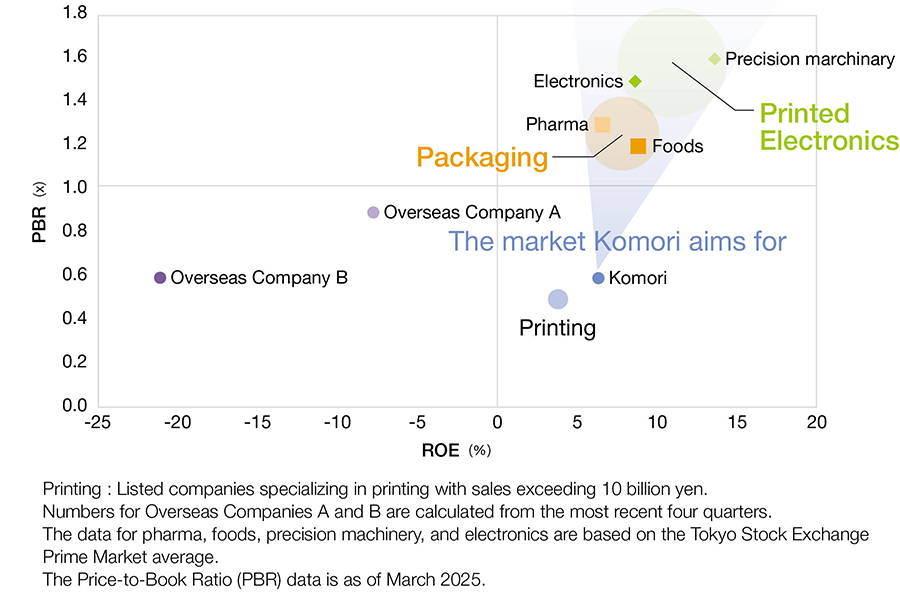

This chart plots ROE and PBR for our company and the printing industry.

Our overseas competitors struggle with profitability, and domestic printing companies are not highly rated either.

We aim to shift our business portfolio toward industries like food, pharmaceuticals, and semiconductors.

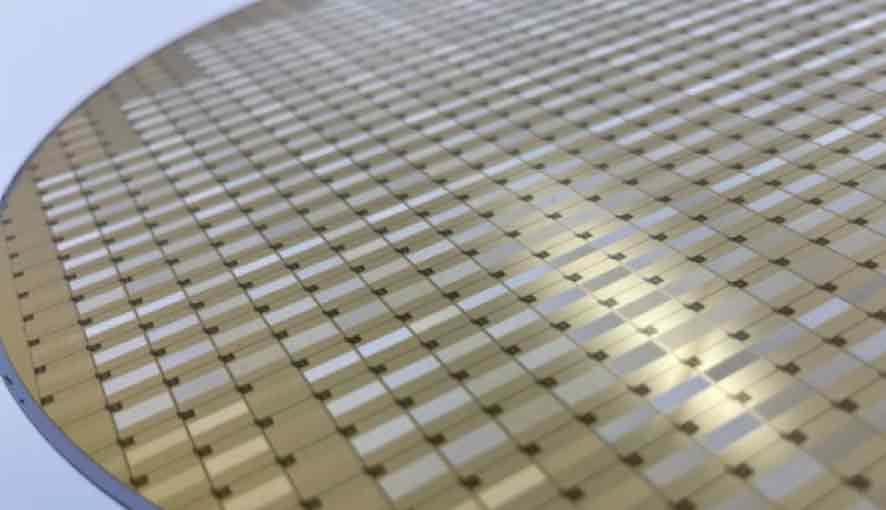

- Semiconductors? That’s a new area. Are you selling printing presses to the semiconductor industry?

Yes, we manufacture and sell printing presses for the semiconductor market.

This field is called Printed Electronics (PE), where printing technology is used to produce PCB and electronic components.

Our subsidiary, Seria Corporation, leads this effort, serving clients in PCB and electronic component manufacturing—quite different from KOMORI’s traditional customer base.

For example, Seria produces Vacuum Coating machine used to fill resin into PCB without bubbles during chip mounting.

These machines are highly rated and expected to grow in demand for high-density PCB in smartphones, automotive electronics, VR, and wearable devices.

- How will KOMORI, with its 100-year history in commercial printing, expand in this new field?

Entering new markets requires external collaboration.

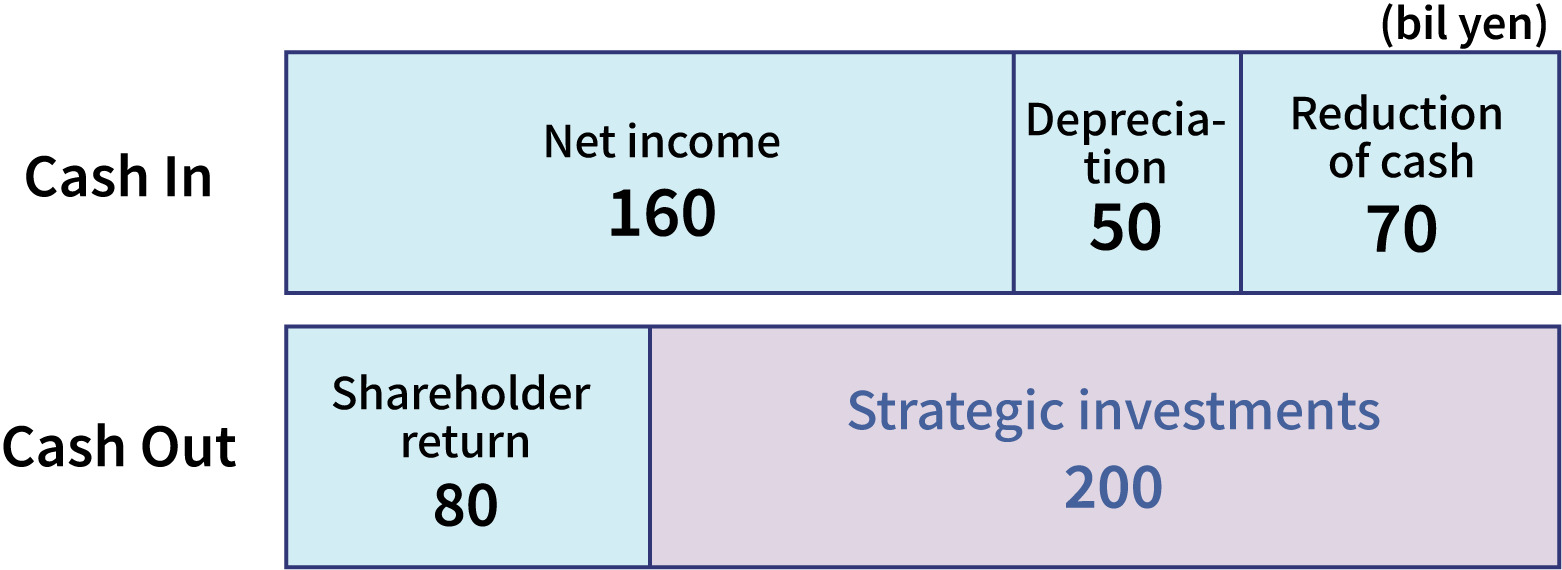

In our 7th Medium-Term Management Plan, we allocated ¥20 billion for strategic investments—¥5 billion for maintenance and renewal, and ¥15 billion for new markets and businesses.

In FY2025, we acquired a packaging company for ¥3 billion to enter the North American market.

This acquisition enabled us to negotiate with major packaging manufacturers and has already led to sales and synergies.

We plan to continue transforming our business portfolio with external support to align with growth markets like semiconductors.

In our 7th Medium-Term Management Plan, we define offset and securities press as core businesses, and digital presses and PE as growth businesses, each with specific challenges and KPIs to drive reform.

For more details, please refer to our Medium-Term Management Plan.