Performance for the Fiscal Year Ending March 2025

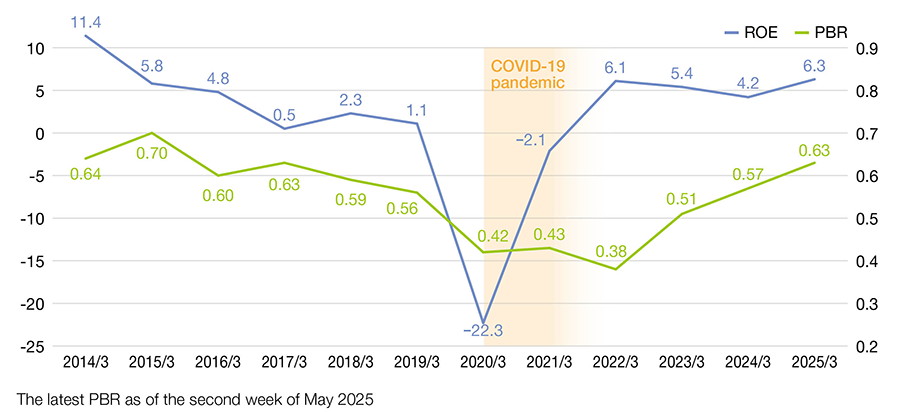

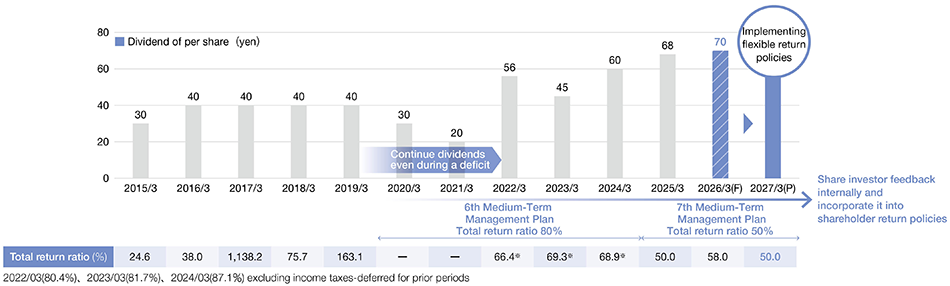

In the fiscal year ending March 2025, we achieved sales of 111.1 billion yen, a 6.5% increase compared to the previous fiscal year. Operating profit was 7.1 billion yen, a 45.3% increase. Net profit attributable to shareholders of the parent company was 7.2 billion yen, a 56.2% increase. ROE was 6.3%, exceeding the 7th mid-term management plan target of 6%. In line with the mid-term management plan's financial policy of a total payout ratio of 50%, the dividend was set at 68 yen. The equity ratio at the end of March 2025 was 66.8%, a decrease of 1.5 percentage points compared to the end of the previous fiscal year.

Contribution of Order Expansion and Margin Improvement to Performance

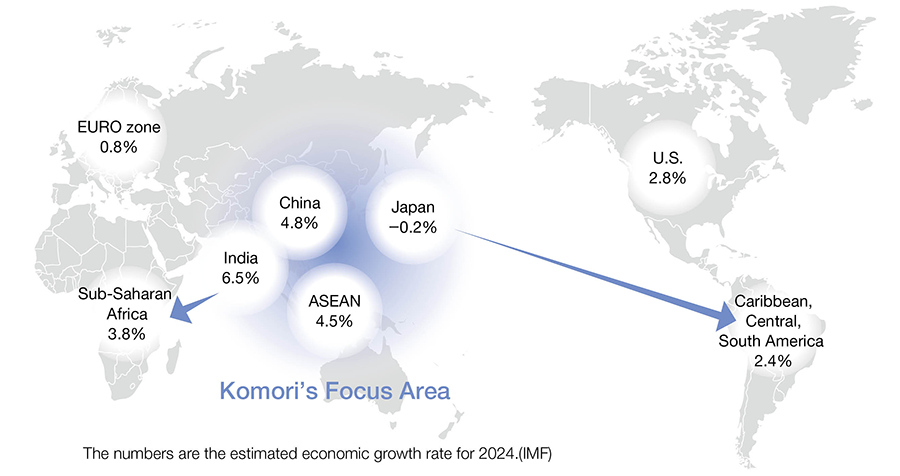

In the fiscal year ending March 2025, Japan domestic and Asian markets performed well. Additionally, due to the impact of the large international exhibition "Drupa 2024" held last May, orders were strong not only in Europe but also in China and Asia. Furthermore, there were large orders in the securities press business in the first quarter, and the effect of the construction progress standards contributed to the increase in sales. Throughout the period, inflationary trends did not subside, and certain cost increases were observed. However, improvements in sales prices significantly exceeded these costs, resulting in substantial profit growth.

Plan for the Fiscal Year Ending March 2026

For the fiscal year ending March 2026, we expect sales of 124.5 billion yen (a 12.1% increase compared to the previous fiscal year), operating profit of 9.1 billion yen (a 27.8% increase), and net profit attributable to shareholders of the parent company of 6.4 billion yen (an 11.7% decrease). Despite the increased uncertainty in the global economy due to significant changes in US tariff policies, we will strive to ensure the contribution of the order backlog at the end of the previous fiscal year (766 billion yen) to sales and cost reduction. We aim to achieve the mid-term management plan target operating profit margin of 7% (7.3% for the fiscal year ending March 2026). At the beginning of the fiscal year, we plan to pay a dividend of 70 yen (35 yen for the first half and 35 yen for the second half), with a total payout ratio of 58%. In addition to the total payout ratio of 50%, we will strengthen shareholder returns as equity capital is trending higher than initially expected due to the market valuation of financial products.

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Regarding Capital Costs, ROE, and PBR

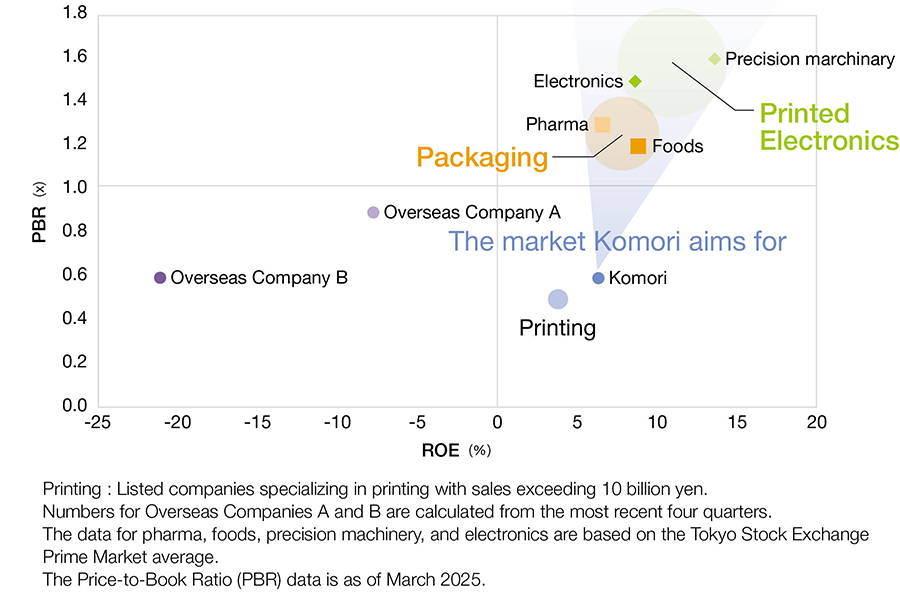

Our company estimates capital costs using a combination of the CAPM theory and stock yield, understanding it to be around 7-8%. Currently, the PBR is significantly below 1.0x, and our mid- to long-term goal is to achieve an ROE that exceeds the capital cost.

Initiatives for Improving Profitability

In the 7th mid-term management plan up to the fiscal year ending March 2027, we have set short-term targets of an operating profit margin of 7% and an ROE of 6%. To achieve an ROE that exceeds the capital cost in the 8th and subsequent plans, we have established a strategic investment framework of 20 billion yen. In the fiscal year ending March 2025, we conducted M&A worth 3 billion yen in the US and Canada to strengthen our packaging sector.

For the fiscal year ending March 2025, the operating profit margin was 6.4% and ROE was 6.3%, exceeding the mid-term management plan target for ROE. The operating profit margin was in the mid-6% range, close to the mid-term management plan target. Recently, KOMORI has been focusing on the high-growth potential Asian markets. The success of past initiatives, such as the acquisition of agencies in Singapore (2014), India (2018), and China (2019) through M&A, has strengthened our distribution channels, and we are seeing the effects on our core business. Although the initial ROE plan for the fiscal year ending March 2025 was below the mid-term KPI of 6%, we have gained confidence by exceeding the mid-term KPI through the actual increase in earnings from Asia.

For the fiscal year ending March 2026, we plan an operating profit margin of 7.3% and an ROE of 5.5%. This year, we aim to exceed the mid-term KPI target of an operating profit margin of 7%.

For future profit improvement, our core business in the offset market will shift from commercial printing, where demand is sluggish, to the packaging sector, with a view towards expanding beyond Asia to Africa and South America. Similarly, in our core business of the securities press market, we aim to increase the number of adopting countries, leveraging our strong financial foundation and the duopoly situation with only one competitor globally.

Regarding our growth businesses, for PE (Printed Electronics), we aim to expand adoption for electronic substrates and components. For DPS (Digital Printing Systems), we plan to strengthen the packaging sector and accelerate the mass production of new models.

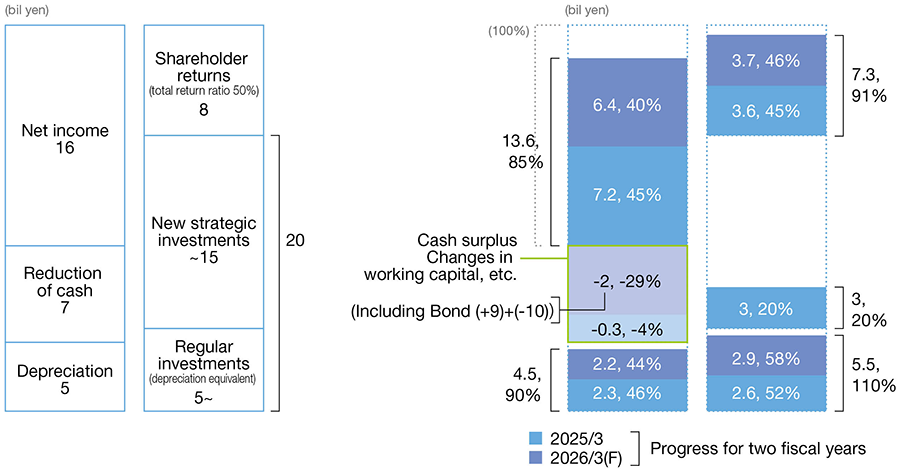

Allocation of Management Resources - Plans and Progress

Regarding the cash flow plan for the mid-term management period, progress up to the second year is on track, excluding strategic investments. Net profit, depreciation, dividends, and traditional capital investments are generally in line with the plan. Due to the careful selection of new strategic investments, there has been no need to draw down cash reserves.

Shareholder Return Initiatives

For the fiscal year ending March 2025, the dividend amount was 68 yen, with a total payout ratio of 50%. For the fiscal year ending March 2026, we plan to pay a dividend of 70 yen at the beginning of the fiscal year (total payout ratio of 58%). In addition to the total payout ratio of 50%, we will strengthen shareholder returns as equity capital is trending higher than initially expected due to the market valuation of financial products.

Feedback from Stakeholders and Internal Sharing

We promptly provide feedback from investors to the management team and conduct quarterly meetings from management to managerial staff to ensure a shared understanding of common issues within the company. Additionally, we share management and financial policies with all employees through the company newsletter.

We will continue to work together as a team to complete the 7th mid-term management plan. We appreciate your continued support.

May 2025