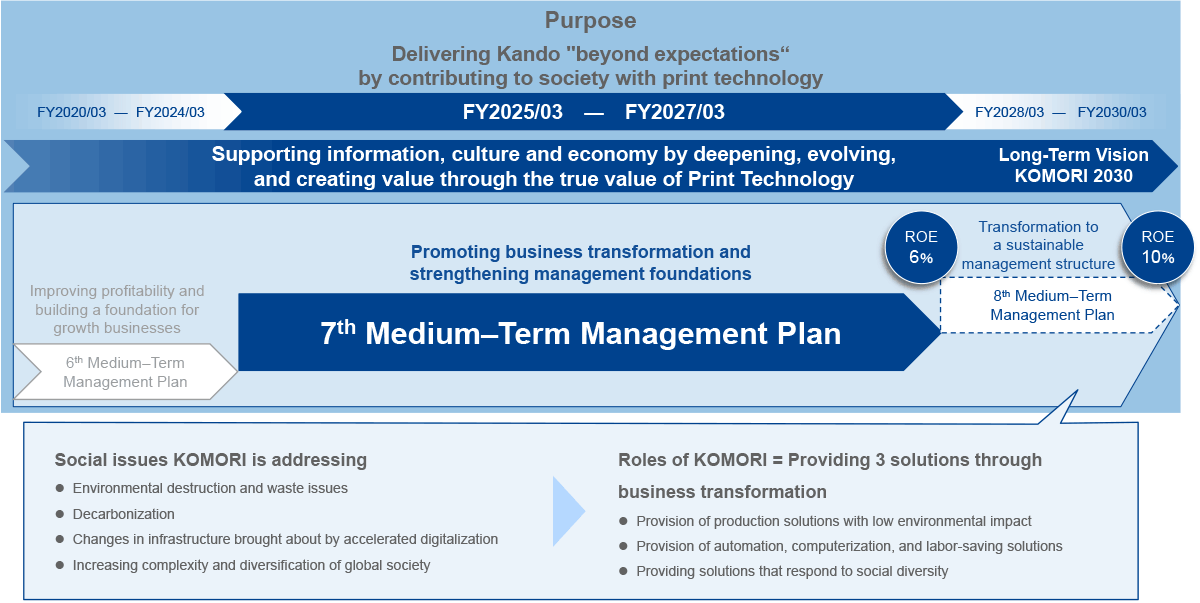

Positioning of the 7th Medium-Term Management Plan

Our new 7th Medium-term Management Plan begins in FY 2025.

Under the 6th Medium-term Management Plan, we aimed to "improve profitability and build a foundation for growth businesses." However, in order to be able to respond flexibly to these rapidly changing economic times, evolve our printing technology, support society, and bring inspiration, the new Medium-term Management Plan will once again focus on "promoting business transformation and strengthening our management foundation" with the aim of laying the foundation for transforming into a sustainable management structure.

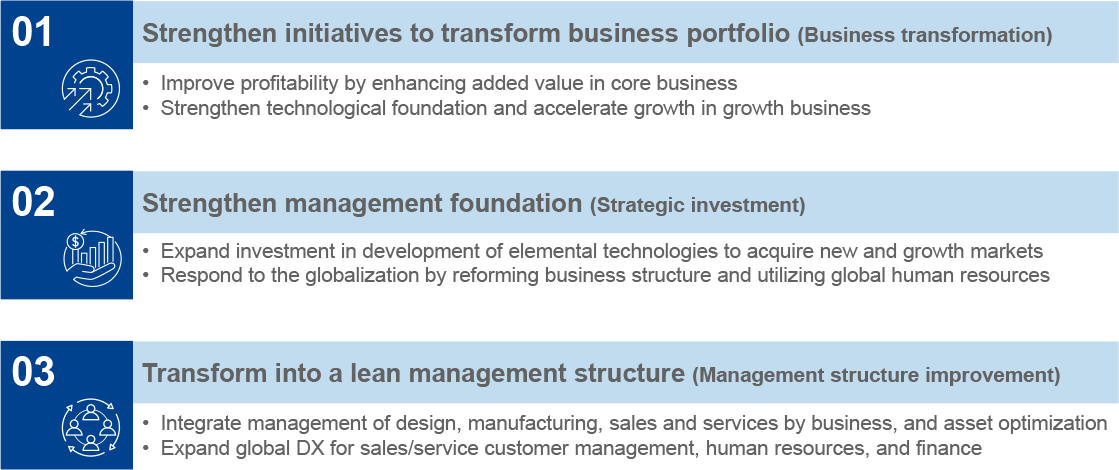

To achieve this, the 7th Medium-term Management Plan has the following three frameworks:

Promoting business transformation and strengthening management foundations for a sustainable management structure

Through these efforts, we will strike a balance between "growth investment" and "ensuring profits," and aim to achieve an operating profit margin of 7% or more and an ROE of 6% or more under the Seventh Medium-Term Management Plan.

| ending March 2024 | ending March 2027 | |

|---|---|---|

| Operating profit margin | 4.7% | 7% or more |

| ROE | 4.2% | 6% or more |